Speak with a Licensed Agent

What is Medicare?

Medicare is a federal health insurance program in the United States designed primarily for people aged 65 and older. It also provides coverage for certain younger individuals with qualified disabilities and those with End-Stage Renal Disease (ESRD) or Amyotrophic Lateral Sclerosis (ALS, also known as Lou Gehrig's disease). Original Medicare is provided through the government and is made up of two parts: A and B

You should sign up for Medicare if you’re 65 or older and don’t have other qualifying health insurance, or if you’re under 65 with certain disabilities. It’s especially important to enroll if you lack "creditable coverage" like employer-sponsored coverage or were self employed, as delays can lead to late enrollment penalties. You may not need to sign up for Medicare immediately if you’re still working and covered by a large employer’s health plan or if you’re covered under your spouse’s employer plan (must have 20+ employees to be considered creditable). In this case, you can delay without penalties until you retire or lose coverage.

Medicare Part A

Generally, Medicare Part A covers:

Inpatient care in a hospital

Skilled nursing facility care

Nursing home care

Hospice care

Home health care

Free for people who have worked 40 qtrs /10years

Medicare Part B

Medicare Part B covers medically necessary outpatient services and preventive care.

Generally, Medicare Part B covers:

Outpatient medical services

Preventive services

Ambulance services

Durable Medical Equipment (DME)

Mental healthcare including inpatient, outpatient and partial hospitalization

Limited outpatient prescription drugs

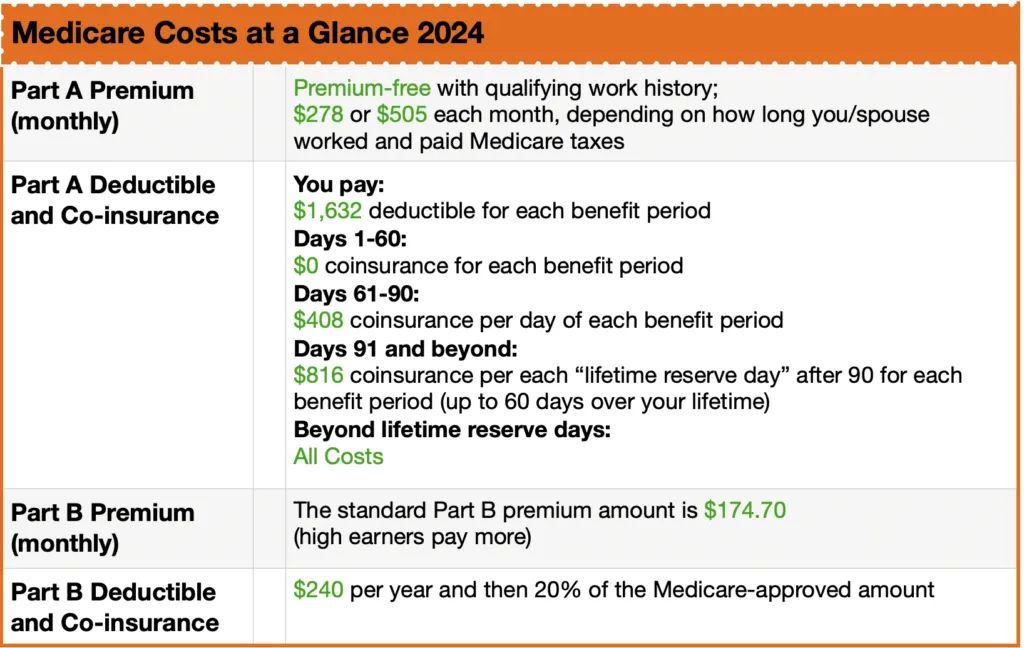

Monthly premium ($174.70 in 2024)

What are the "gaps" in Original Medicare?

Original Medicare (Part A and Part B) covers many healthcare services but has NO YEARLY LIMIT on out-of-pocket costs and does not cover services like dental, vision, hearing aids, long-term care, and most prescription drugs without additional plans...To fill these gaps, you’ll need supplemental coverage, like a Medigap policy or a Medicare Advantage Plan.

For example, a $100,000 medical bill with just Original Medicare (Parts A and B):

Part A: You pay the $1,632 deductible for hospital services.

Part B: After the $240 deductible, Medicare pays 80% you pay 20% coinsurance on the the remaining $99,760, which equals $19,952.

Total Out-of-Pocket Costs:

Part A Deductible: $1,632

Part B Costs: $240 deductible + $19,952 coinsurance

Grand Total: $21,824 out of pocket!

Ready to get started?

Call Jake: 855-622-6880

Email: [email protected]

Call Victoria: 855-624-4972

Email: [email protected]

Carriers we work with

Not affiliated with the U. S. government or federal Medicare program.

We do not offer every plan available in your area. Any information is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800- MEDICARE to get information on all your options. Please be aware that you are not required to give any health-related information; unless this information is needed to determine your eligibility to enroll in the plan. If you choose not to provide the requested health information you may not be able to enroll in the plan. Any information you provide during this call will not affect your ability to request enrollment or your membership in a plan.

© 2026 Copyright Brokers USA

All rights reserved.

Terms & Conditions | Privacy Policy