Speak with a Licensed Agent

What are Medicare Supplement plans?

Medicare Supplement plans, also called "Medigap" plans, fill in the "gaps" not covered by Original Medicare. Original Medicare only covers 80% of your Part A and Part B expenses, leaving the remaining 20% as your responsibility. These out-of-pocket costs can be overwhelming if you face a serious medical condition.

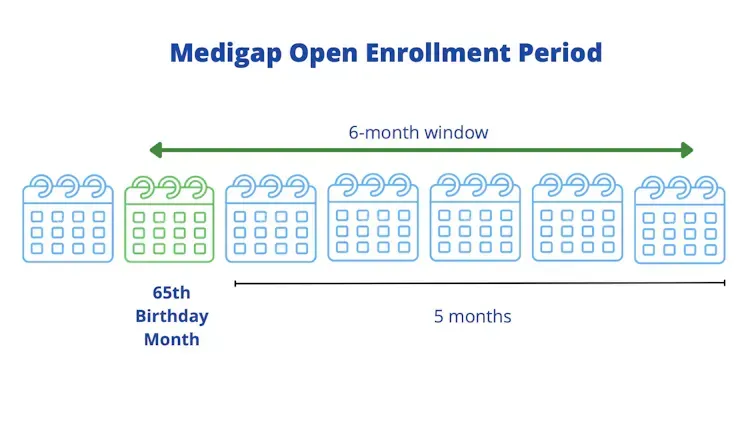

The best time to buy a policy is during your Medigap Open Enrollment Period, a six-month window that starts when you first enroll in Medicare Part B. During this time, you can purchase any Medigap plan without worrying about medical underwriting, meaning insurers cannot deny you coverage or charge you higher premiums based on pre-existing conditions although rates are still subject to change on a yearly basis.

What do Medigap plans cover?

Medigap (also known as Medicare Supplement Insurance) is designed to work alongside Original Medicare (Parts A and B) to help cover the out-of-pocket costs that Medicare doesn’t fully pay. There are no networks (HMO/PPO) so you can see any doctor nationwide as long as they accept Medicare. Here’s how it works in more detail:

Primary Coverage: When you receive healthcare services, Original Medicare is billed first. Medicare covers its portion, typically 80% of approved services after deductibles.

Secondary Coverage with Medigap: Once Medicare has paid its share, your Medigap policy steps in to cover some or all of the remaining costs. This includes things like:

Deductibles(the amount you pay before Medicare begins to cover).

Coinsurance (your share of the costs after meeting your deductible, 20%).

Copayments (fixed amounts for certain services, like doctor visits or hospital stays).

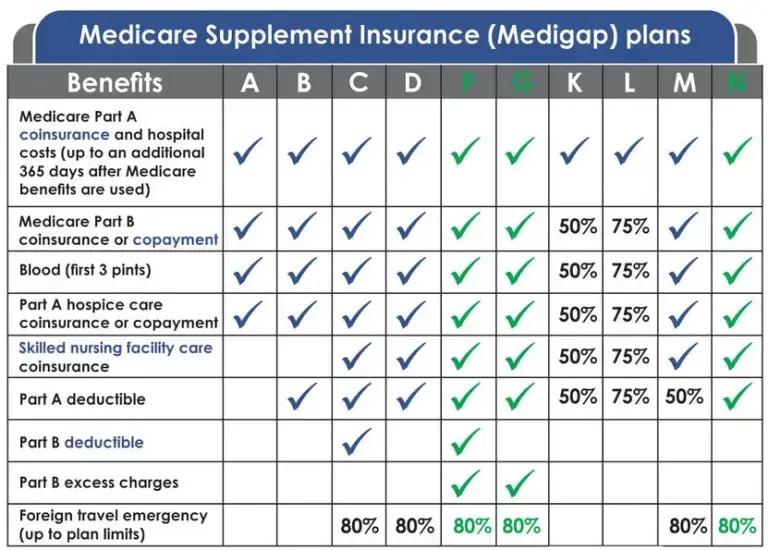

Plan Flexibility: Medigap plans are offered by private insurance companies, but they are standardized by Medicare. This means that Plan A from one company will offer the same benefits as Plan A from another, though premiums may vary. There are 10 standardized plans (labeled A, B, C, D, F, G, K, L, M, N), each offering different levels of coverage.

*There are some differences with Medicare Supplement plan standardization in Massachusetts, Minnesota and Wisconsin.

What Medigap Doesn’t Cover:

Prescription drugs : You need a separate Part D plan for medications.

Long-term care: Medigap does not cover services like nursing home care or home healthcare.

Vision, dental, hearing aids, and routine eye exams: These services are also not included and would require separate insurance.

How do I Enroll in a Medicare Advantage Plan?

A licensed agent can help you review plan options in your area. Please contact us at (855) 624-4972 (TTY: 711) to get started!

Call Jake: 855-622-6880

Email: [email protected]

Call Victoria: 855-624-4972

Email: [email protected]

Carriers we work with

Not affiliated with the U. S. government or federal Medicare program.

We do not offer every plan available in your area. Any information is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800- MEDICARE to get information on all your options. Please be aware that you are not required to give any health-related information; unless this information is needed to determine your eligibility to enroll in the plan. If you choose not to provide the requested health information you may not be able to enroll in the plan. Any information you provide during this call will not affect your ability to request enrollment or your membership in a plan.

© 2026 Copyright Brokers USA

All rights reserved.

Terms & Conditions | Privacy Policy